Award-winning PDF software

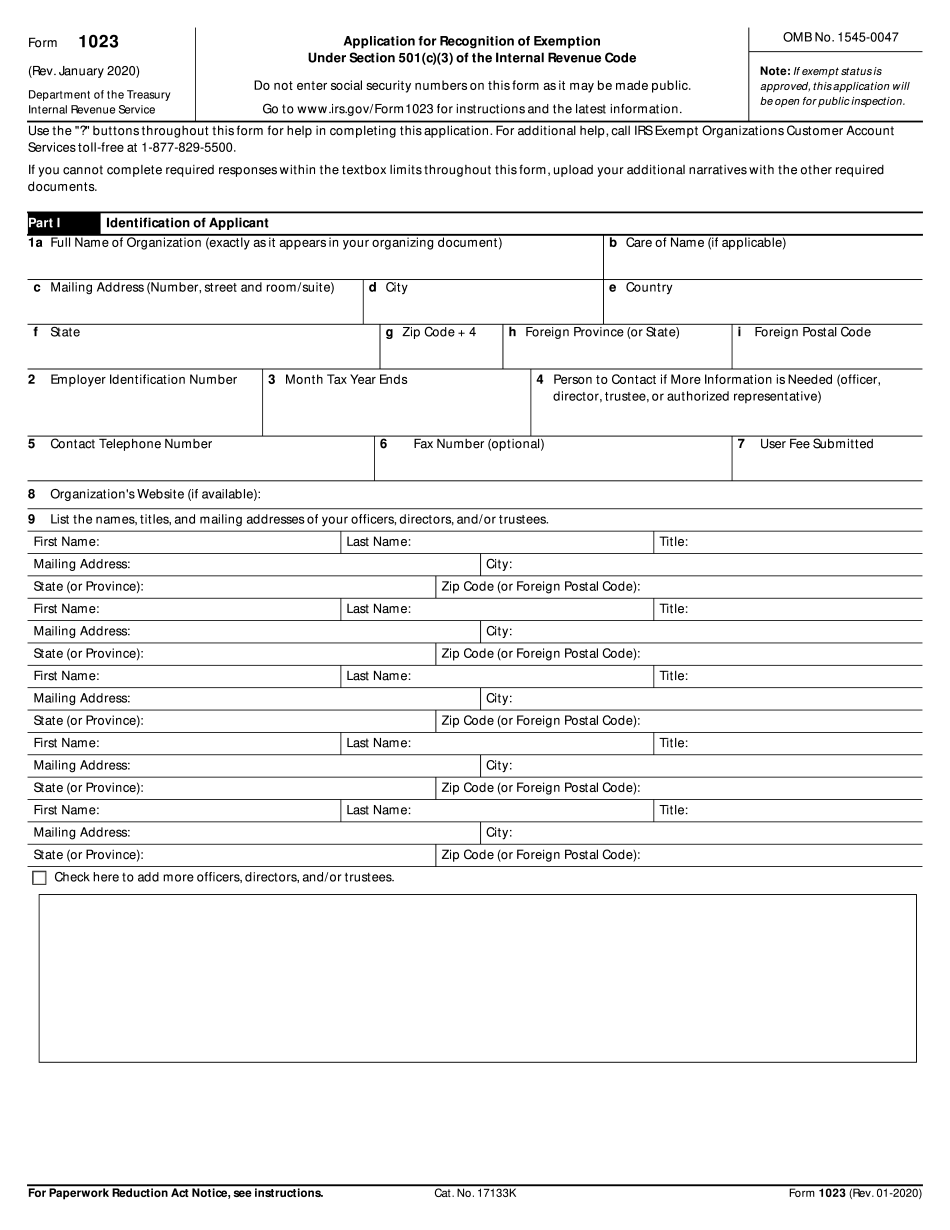

Step 4: filing for federal tax-exempt status - national

Ores, social service agencies, and foreign organizations). This exception does not apply to service organizations, federal government contractors, and certain other organizations designated by the Secretary of the Treasury. This exception allows an individual or an organization within a corporation to engage in a specified business activity as an exempt organization in order to provide certain services to a small business. This exception does not apply to foreign service organizations under subpart Q of part 8. DUE DILIGENCE: Because the rule applies to certain entities, entities with limited or no revenue and income, or only limited assets may be considered to qualify as small for small business purposes. The rule applies to a taxpayer as defined in the first paragraph of §(b)(1)(iii) and applies to an entity, the gross receipts of which are less than 250,000 that is either an operating division, operating cooperative or similar organization described in §(c)(5)(ii) or.

form 1023 instructions & help with 501c3 application

The application is also a quick and easy way to file. The exemption is valid for 5 years from its filing date or until Dec. 31, whichever expires longest. The form 1023 EZ can be filed by mail or in person with an authorized IRS agent. If an application is approved, taxpayers may pay tax using Form 1023. Individuals who are eligible are required to give a copy of any tax payment(s) to the IRS at no cost. Taxpayers may have their forms verified to ensure they are eligible for the 1023 EZ. Once a tax payment is received, the IRS must mail the exemption within 90 days. Taxpayers cannot obtain an exemption for a future tax year by claiming that their Form 1023 EZ should have received an exemption (in case of the loss tax credit). Why Use Form 1023 EZ An exemption application is a very convenient way to reduce.

form 1023-ez application for 501(c)(3) nonprofits

Acknowledging that the 1023-EZ is an easier-to-use, streamlined version of the 1023 in theory, it in practice is far from that. Form 1023-EZ is designed to be electronically filed, yet it is the IRS' first attempt to require electronic filing. As a new IRS form designed to simplify the tax-filing process, the 1023-EZ has become a key tool for the IRS in its effort to achieve compliance with new privacy and disclosure policies. To date the 1023-EZ has generated over 5 million returns. The IRS forms used to be hard to navigate and required some level of expertise. Not anymore! A brand new, streamlined version of IRS form 1023, Form 1023 EZ, is now available to use online. For those organizations with limited IT capabilities, a self-service version of the 1023-EZ can be used by email and print. In addition, a separate Form 1023-EZ will now help organizations file the IRS' updated 2014.

Everything you need to know about the form 1023 ez

Find out how you must prepare your non-profit for filing 1023 EZ Forms Why Do I Need to File 1023 Forms? There's a lot of jargon at one time—but there's really only one way to avoid being a legal black hole—not filing 1023 forms. If you're not ready to register your nonprofit as a for-profit business, you'll need to file 1023 forms. If you don't file a 1023 Form by January of the fourth year of your first IRS tax filing (you should have started that on April 1, 1998), or if you owe more than 50,000 in taxes that are not tax-exempt, your organization won't be able to do ANYTHING unless the IRS gives the OK to do so. It's that simple. (And as a side note—the IRS is pretty good about helping nonprofits file their 1023 Forms if they do so in a timely manner.) Here are more reasons that you.

form 1023-ez: nonprofits rejoice – but is the potential for

In some ways, it's a more streamlined version of the 1040EZ. It has the same requirements about income, expenses, marital status for single tax filers, married conjoint filers and tax filing status for jointly filed returns. Form 1023-EZ is a substitute for the IRS Form 1023 and has a lot of similar information. There are some important differences that I'll get to in a moment. Here's the overview of what you are supposed to report by either form or 1023 when filing your return: Income (line 7, column A)--This is the total income for the year, including all the money that you and your spouse, if you're filing a joint return, earned from all sources and all wages, salaries, pensions, annuities, and interest paid, for instance, on business and investment income earned by you or your spouse. Expenses of living in the United States (line 11, column B)--This is the.