Award-winning PDF software

Form 1023 for South Bend Indiana: What You Should Know

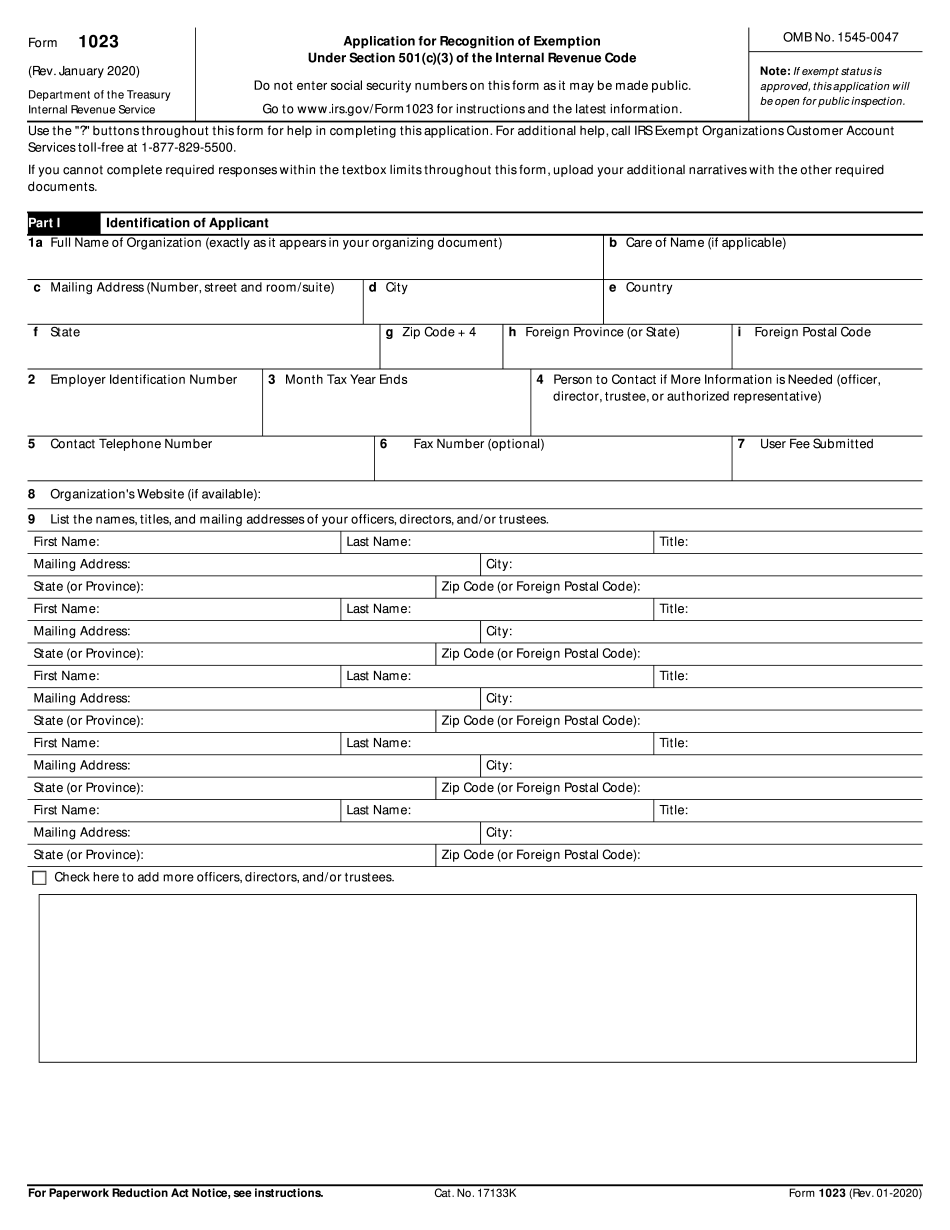

Revocation · Add new employees and directors · Update a “Who's On Deck Page” · Complete the Form 2053 with your proposed Form 1023 or amended Form 1023 · Submit Forms 1023-EZ as well as Form 1023-EZ-RR as required · Upload your completed tax return with Form 1023 when finished. Blackbird will provide your updated tax return to you by email/SMS. . . You will then have the option to view the completed tax return, if applicable, or to print the completed tax return and return template on both the IRS and the non-IRS government websites. Form 1023 — Eligible Organizations must submit the same basic information for all filers but may provide additional information. Complete the Form 1023—Employee's Compensation and Conflict of Interest Forms · Document your Board of Directors · Add or amend any information about your organization's activities, including financial statements, to ensure that the IRS has the most complete and accurate information. · Provide a signed statement by the President or Vice President of the corporation, the principal executive officer, the secretary or other officer controlling financial and financial transactions with the corporation, or a director or officer of the corporation who is also the president or vice president, confirming that the corporation is subject to Title 31 and that the corporation's business is being conducted primarily for exempt purposes. In addition, the Form 1023 must include the entity's annual report and the corporation's Form 1023-EZ, which is a document that summarizes the corporation's activities, and, when required, a statement of a relationship between the corporation and an organization that is exempt from tax under Section 501(c)(3). · Document the status of the corporation and the status of all officers, directors and employees and the date of the last officer, director or employee serving on the board of directors. · Document any payments to directors made on behalf of an organization exempt under Section 501(c)(3). · Document the corporation's current activities and any new projects for which financial assistance is being obtained from a nonprofit, governmental entity, a corporate foundation or other exempt persons. · Complete and sign the IRS Declaration of Compliance and Return of Federal Information Disclosure Regarding Certain Tax-Exempt Organizations (Form 990-EZ-A), and submit it to the IRS with the application for recognition of your nonexempt status. · The IRS will review it to confirm the information and provide the organization with a written opinion if necessary.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 1023 for South Bend Indiana, keep away from glitches and furnish it inside a timely method:

How to complete a Form 1023 for South Bend Indiana?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 1023 for South Bend Indiana aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 1023 for South Bend Indiana from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.