Award-winning PDF software

Form 1023 Renton Washington: What You Should Know

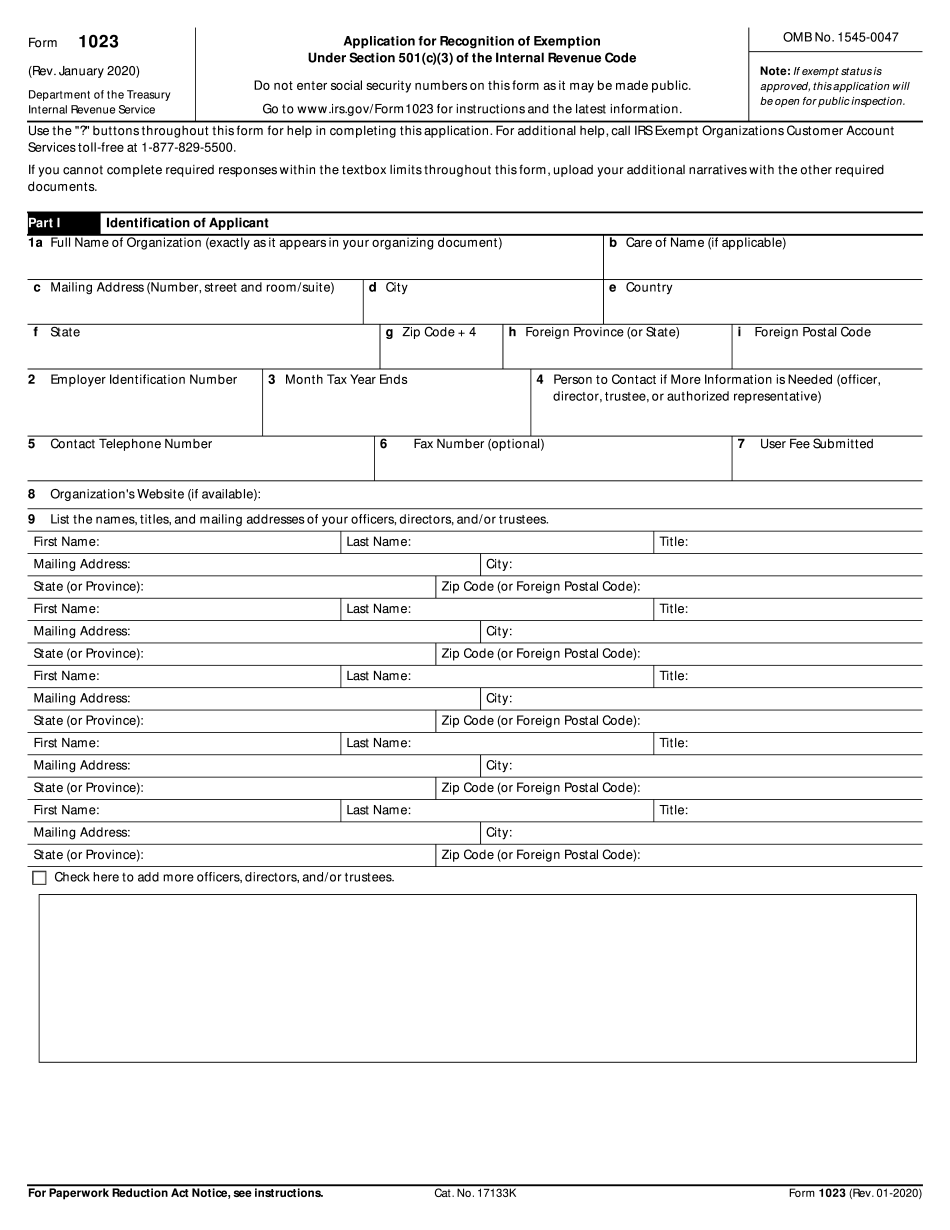

To read more on the Form 1023, Application For Recognition of What is Form 1023, Application for Recognition of Exemption? Form 1023 is a simplified application for recognition of exemption under section 501(c)(3) of the Internal Revenue Code, commonly referred to as “Section 501(c)(3) Nonprofits.” It provides a single, streamlined form that simplifies the process of applying to state and Federal tax-exempt status. This is particularly appealing to organizations not seeking recognition of their status and that are organized for the express purpose of conducting charitable activities. Many individuals have been frustrated with the complicated, cumbersome, and time-consuming process of applying for recognition. While most organizations (even those organized for the express purpose of conducting charitable activities) are eligible to apply for exemption, there are some groups of interest. This checklist contains information you will need in order to apply for exemption for a Washington organization. It should be used by organizations organized for the express purpose of conducting charitable activities. Form 1023 Checklist — Northwest State Foundation If you have any questions about the Form 1023, Application for detailed information about Washington-based 501(c)(3) organizations, see: The form must be filed electronically with the Taxpayer's Identification Number (TIN). If it is a paper form, it must be signed and dated by the owner or manager that the form was received by. The IRS does not accept photocopied applications or mail. If your organization wants to be considered for recognition in Washington (federal tax-exempt status) you must fill out the application in accordance with the steps on this checklist. 1. 2. Fill out Form 1023. To read the IRS guidance on tax-exempt status for 501(c)(3) organizations, Read “Form 1023, Application for Recognition of Exemption Under Section 501(c)(3) of the Internal Revenue Code,” in PDF format. When filing the Form 1023, you must identify which states you operate in, and which is your primary purpose for doing so in each state. If your primary purpose is conducting charity activities, you must provide the names and addresses of all charities in the state to which you do business. Read about “Washington state corporate government reporting requirements,” and the IRS Publication 970 (Tax Guide for Business Entities).

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 1023 Renton Washington, keep away from glitches and furnish it inside a timely method:

How to complete a Form 1023 Renton Washington?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 1023 Renton Washington aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 1023 Renton Washington from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.