Award-winning PDF software

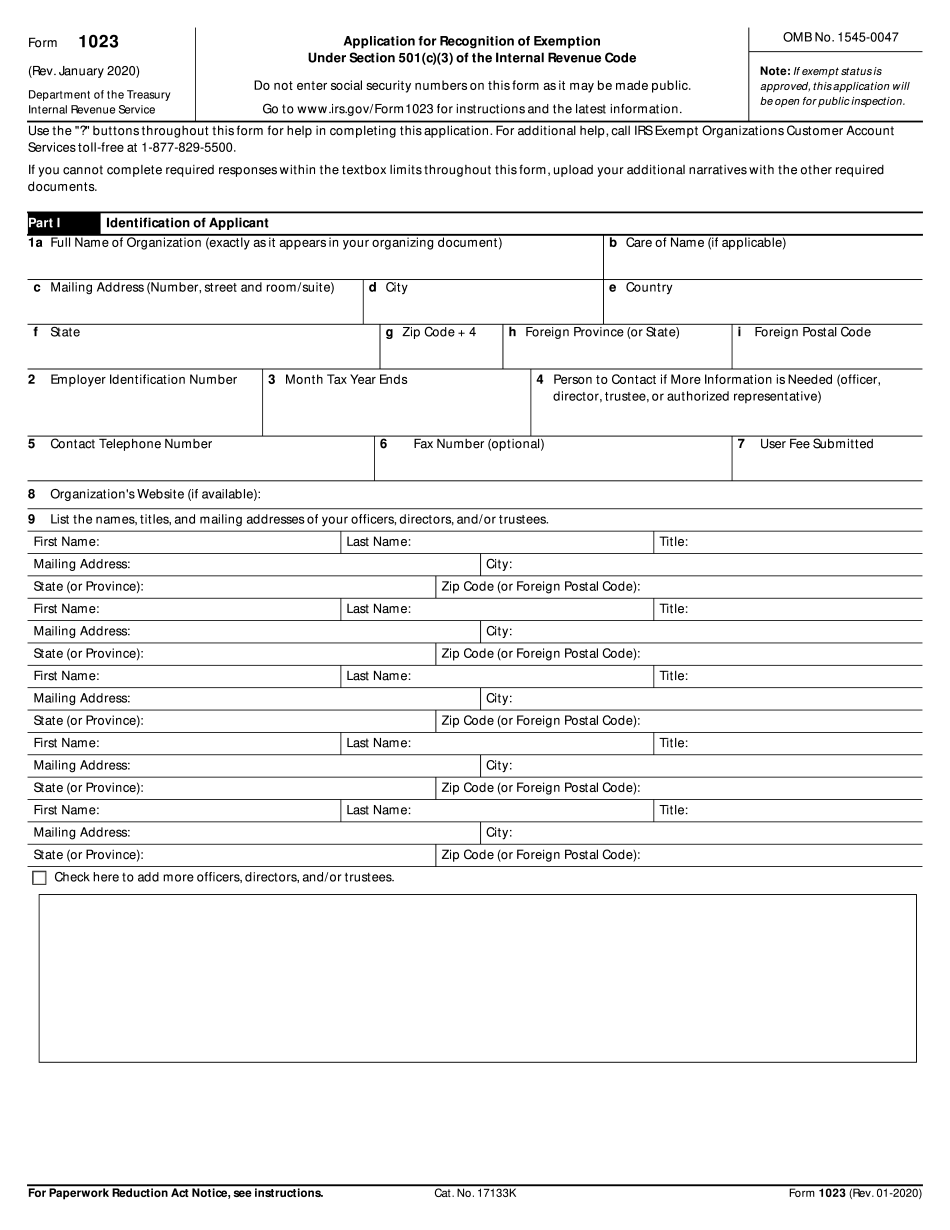

Las Vegas Nevada Form 1023: What You Should Know

Tax Free Bounties The Internal Revenue Service recently announced it is waiving tax on non-cash donations of up to 10,000 to nonprofits. You can only get a tax break on a non-cash donation of 10,000 or more when the recipient is a 501(c)(3) non-profit. Please visit my previous post on nonprofit tax breaks for even more information. In addition to this, the 501(c)(3)'s that get a state tax-free bonus will not need to file to get an exemption from Nevada's business tax! If the tax-free bonus is for a different organization, you will need to file a separate tax return! How to Form a Nonprofit Corporation — Form 990 In order to form a corporation, you must file this form to the Nevada Secretary of State and fill it all out. Form 990 is available through the state corporation division of the Nevada Department of Taxation and Finance. If you are going to open a business in Nevada and are going to get a tax-free bonus, this is a form you should consider filing. How to Start a Corporation in the state of Nevada— Fictitious Business Forms 1, 3, 4 are designed to open or modify a corporation. For more on filing, you can contact the Nevada Department of Taxation and Finance to make an appointment to meet with them for this process. The Nevada Secretary of State also has information on how to register new limited liability companies. You are also able to go to the Nevada Secretary of State and register a fictitious business, with all the paperwork, as long as all the required information is provided to the Nevada Department of Taxation. How to Form a Corporation in the state of Nevada — Business Entity Form 2-F is your business entity form (also called a limited liability company or LP, located in Nevada). It is a good idea to file Form 2-F with the Nevada Secretary of State so that you can open and maintain your nonprofit corporation on a Nevada LLC. Please note that Nevada LCS are called a C Corporation. If you plan on making a profit on a new venture, or are thinking about how to increase or increase the size of your company, then you will need to file a Nevada business entity.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Las Vegas Nevada Form 1023, keep away from glitches and furnish it inside a timely method:

How to complete a Las Vegas Nevada Form 1023?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Las Vegas Nevada Form 1023 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Las Vegas Nevada Form 1023 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.