Award-winning PDF software

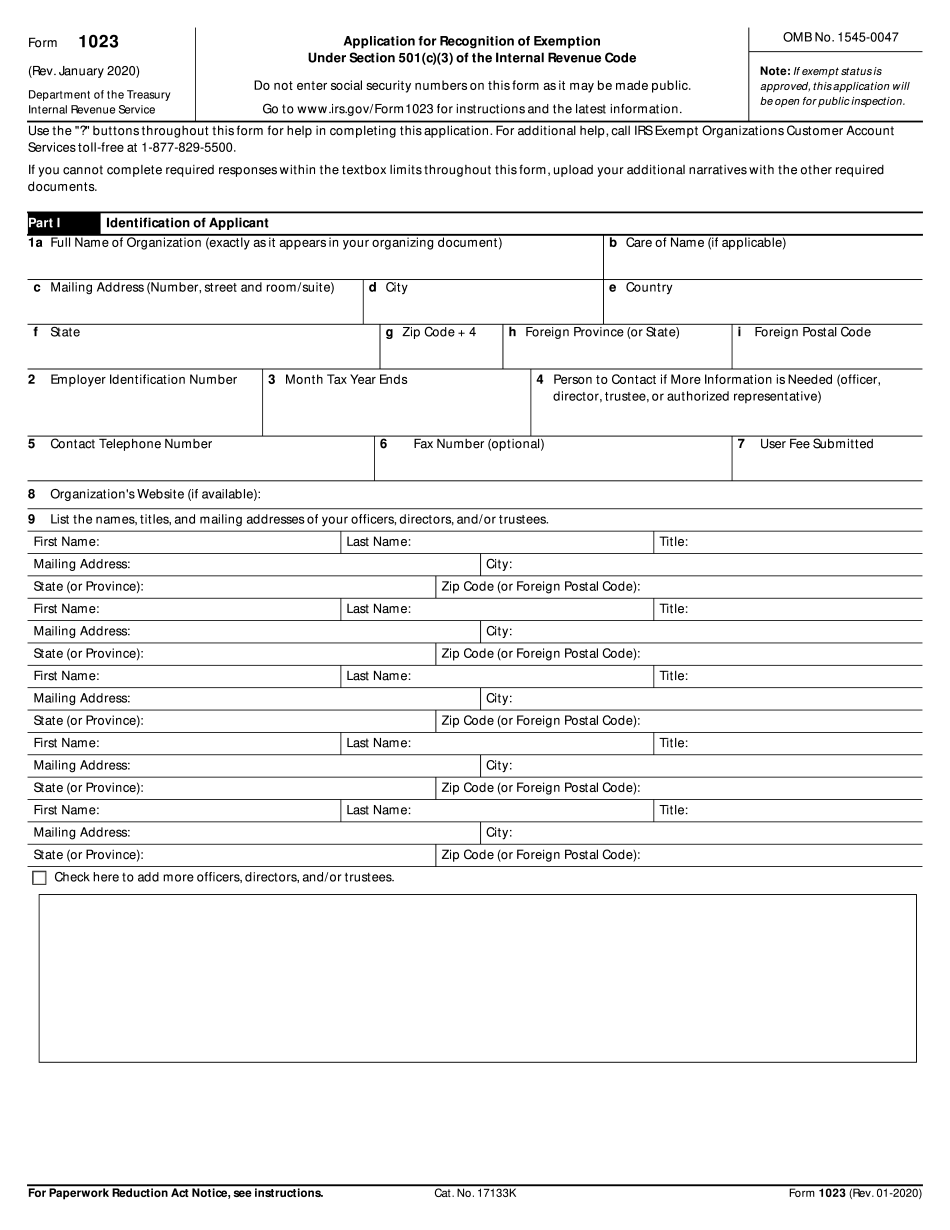

Printable Form 1023 San Angelo Texas: What You Should Know

Download the form to fill out and send directly to the IRS. Form 1023 (Rev. 11-16). Form 1023 for San Angelo Independent School District, Tom Green County Independent School District, Texas 2015, Digital Arts, a division of MM Publishing. All rights reserved. About the Form. Send the PDF file or the text version if the application includes a form letter with the complete text of section 501(c) or 501(c)(4) of the Internal Revenue Code, as amended by section 5301 of the Code. For further information on the application form, please call the nearest IRS office at. Applications may take up to 14 days to process. For further details, please see Revenue Procedure 2012-51 and Publication 519 (Circular E, Exempt Organizations and Other Taxable Entities). Form 1023 (Rev. 12-20). Form 1023 for San Angelo Independent School District, Tom Green County Independent School District, Texas 2015, Digital Arts, a division of MM Publishing. All rights reserved. About Schedule B and Form 1023 Schedule B (Form 1023) for San Angelo Independent School District, Tom Green County Independent School District, Texas (PDF) includes several items: the filing fee, and an IRS Form 2553 — Certification of Exemption and Return of Exempt Organization Information — Certification from a Tax Exempt Organizational Unit — for use in lieu of the Form 1023. When filing Form 1023, you must send the forms to the following address: San Angelo Independent School District, Tom Green County Independent School District, Texas If you do not have a mailing address when applying for recognition, you can find your mailing address by accessing Forms and Records Online: IRS.gov Schedule B (Form 1023, Rev 11-16) is used to file a tax-exempt application to a public school (or charter school, as applicable) organized under Section 501(c)(3) of the Internal Revenue Code. You will be asked to indicate the types of activities you intend to conduct and the amount of money you intend to apply. If any items are missing or incorrect, or if the IRS is requesting supplementary information, you should include that information with your application. Additional Forms for Schools Tax exemptions are specifically allowed in Section 501(c)(3) of the Internal Revenue Code.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable Form 1023 San Angelo Texas, keep away from glitches and furnish it inside a timely method:

How to complete a Printable Form 1023 San Angelo Texas?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable Form 1023 San Angelo Texas aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable Form 1023 San Angelo Texas from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.