Award-winning PDF software

Form 1023 for Franklin Ohio: What You Should Know

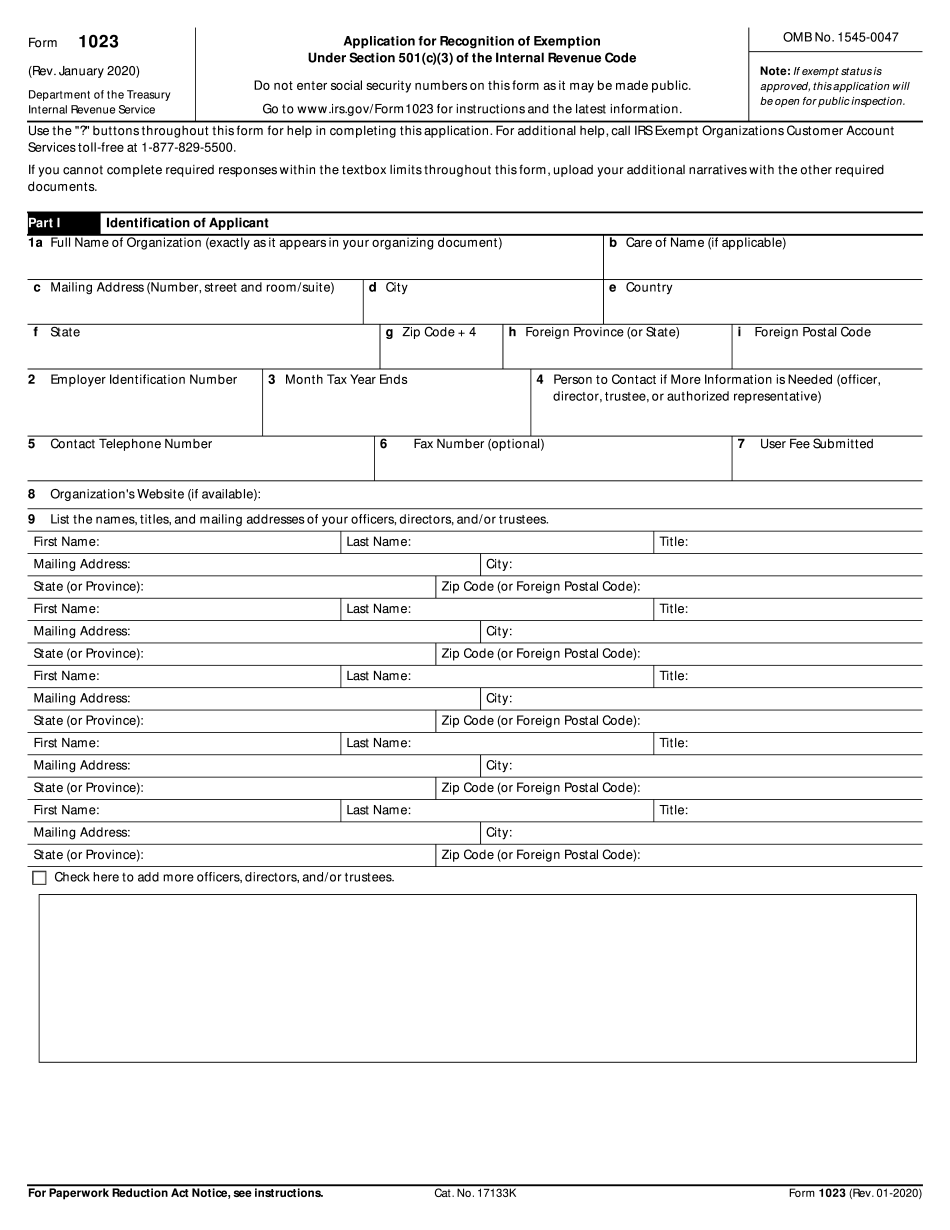

Schedule R-2—Form Section 468-C The Schedule R-2 is a return prepared by the Internal Revenue Service to compute a tax liability (including nonrefundable credits for the adoption or birth of dependents). The Schedule R-2 is available to eligible organizations. To file a Schedule R-2, fill out the new Schedule R-2 and submit it to the tax agent. If Form 468 is not filed on paper, submit a signed, notarized copy of your request for information to the IRS. Schedule R-2 (Rev. November 2017) — IRS Submit your original and amended organization Form (for instance a new Form 1 that incorporates Form 468), your original and amended organizing documents (for instance a Statement of Organization), and a copy of the IRS application for recognition of exemption. 1 Section Tax Division Forms | Franklin, Ohio Additional Information Organized Activity Activities (Organizations) may not have to file the IRS Form 1023. Organizations may be tax-exempt even if they do not have to file the IRS Form 1023. The IRS will consider whether the organization is a bona fide religious organization. However, an organization is “benevolent” for federal purposes if the organization has “reasonable belief” that, under the circumstances, the activities and/or conduct of its members (each a “member”) are not in conflict with generally accepted religious standards that are a substantial part, if any, of the organization's operations. The IRS also considers membership in a trade association, business trust, or cooperative a substantial part of an organization's operations. The IRS defines these standards as the organization's membership dues, fees, and support activities, such as the organization's annual meetings and publications. However, a membership in an organization can change over time. It will also determine whether a member is, for religious purposes, obligated to pay a certain type of membership dues, fees, and support activities of the organization unless the organization has reasonable belief that, under the circumstances, the member is not required to pay such dues, fees, and support activities. See IRS Publication 527, Tax Guide for Small Business for more information.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 1023 for Franklin Ohio, keep away from glitches and furnish it inside a timely method:

How to complete a Form 1023 for Franklin Ohio?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 1023 for Franklin Ohio aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 1023 for Franklin Ohio from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.