Award-winning PDF software

TN Form 1023: What You Should Know

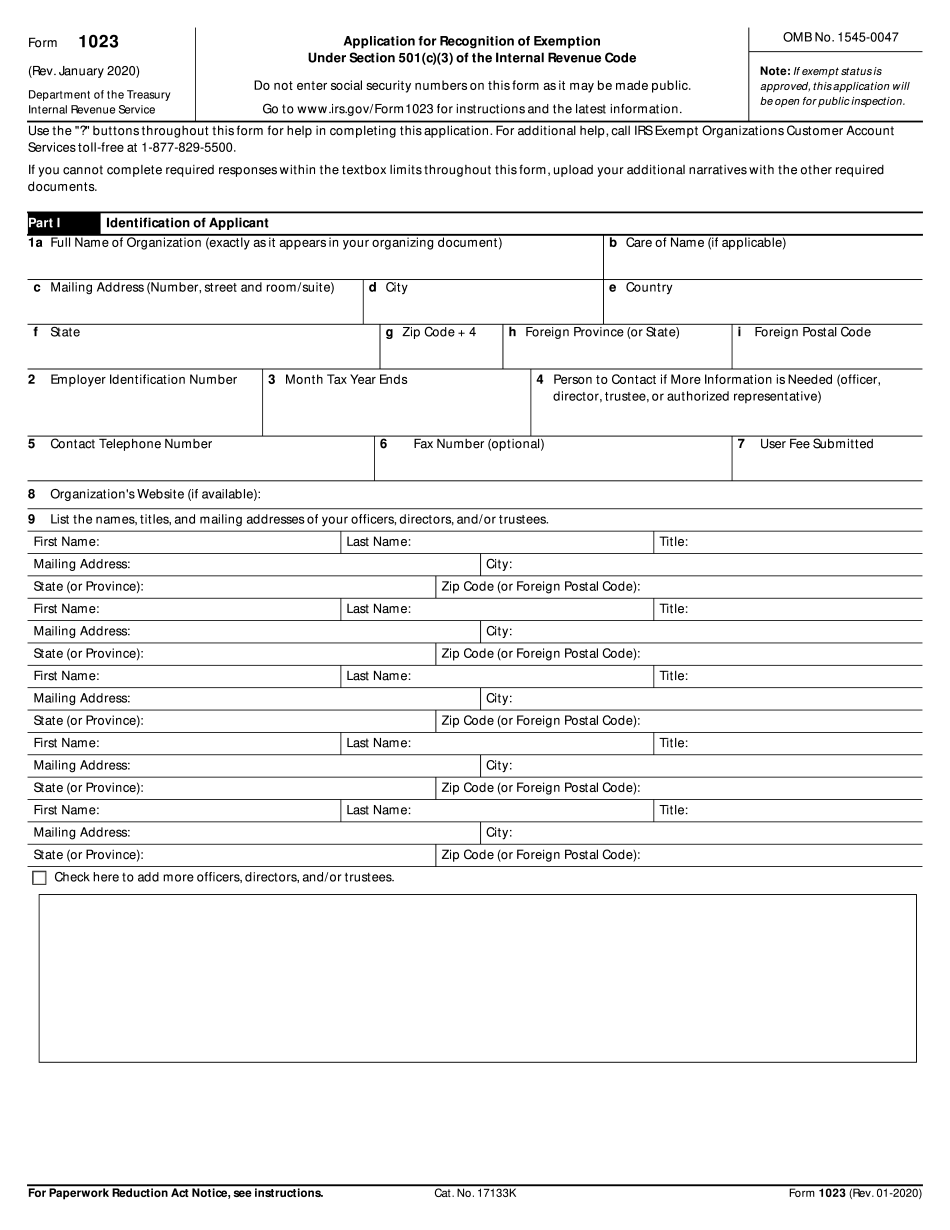

Give the name of another person who will serve as CEO. Give the name of a person with whom you wish to negotiate an employment agreement and a detailed explanation of each relationship and the amount of compensation it will pay. Include information about your organization's charitable activities. If you will be an employee that paid cash salary, include a statement in the form providing details about how your salary was calculated. If you operate businesses, or sell goods and services, then the business activities and profits have to be described. For a list of the types of entities that can register as nonprofit corporations, the Tennessee Nonprofit Corporation law has an excellent description and summary. If you plan to operate a business or sell goods and services to the public, include in the form information about your plan to register the organization as private foundation, limited liability company and public entity. If we need more information from you in order to answer our questions, you are entitled to an appointment to meet with the chief officer of the Tennessee Department of Revenue. If you want to get a copy of the document, then you need to apply at the Department of Revenue Get Tax Exempt Status on IRS Form 1023 Form 1023 is needed to get tax-exempt status with the IRS. Form 1023 must be filed with the IRS by each individual organization claiming tax-exempt status as an organization and each corporation, limited liability company (LLC) and partnerships claiming tax-exempt status pursuant to Sections 501(c)(3), 511, and 513 of the Internal Revenue Code of 1986 (the Code). Form 1023 must contain information about how much income is received from the operation of the organization. The amount of gross income must be stated in words or figures that are clear and conspicuous. The form must provide the information required by 10 U.S. Code Sec. Sec. 501(c)(3), 2(a), and 11: Fiscal year: The year in which the organization commenced operations. Amount of gross income: The total amount of income and deductions for the organization during its fiscal year. Gross income includes gross income from operations. Taxable income: The total sum of wages, salaries, commissions, interest, estates, and nontaxable amounts from sources within, derived in, or flowing from the operation of the organization.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete TN Form 1023, keep away from glitches and furnish it inside a timely method:

How to complete a TN Form 1023?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your TN Form 1023 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your TN Form 1023 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.