Award-winning PDF software

How to prepare Form 1023

About Form 1023

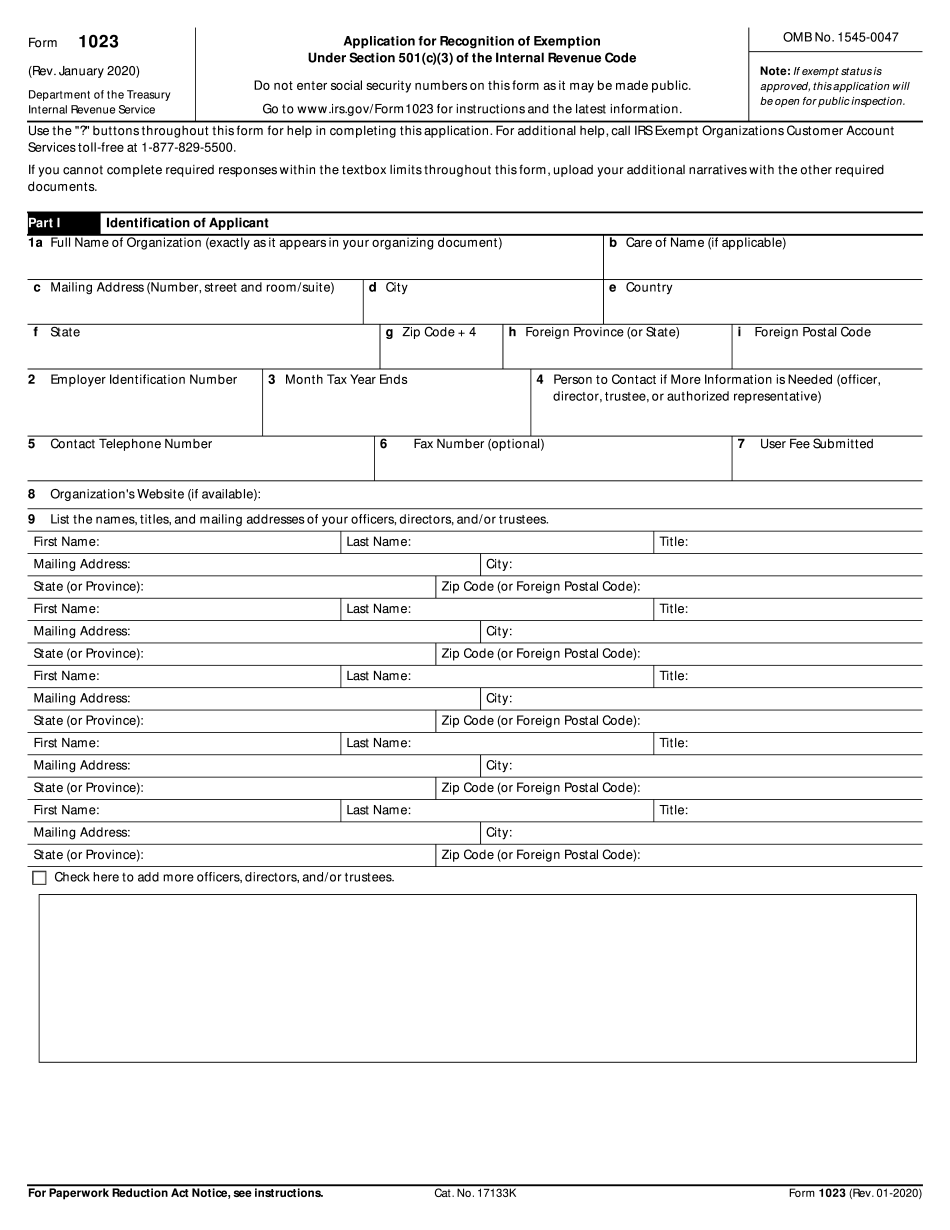

Form 1023 is the application that nonprofit organizations in the United States need to file with the Internal Revenue Service (IRS) to request tax-exempt status under section 501(c)(3) of the Internal Revenue Code. This form is specifically for organizations seeking to be classified as charitable, religious, educational, scientific, literary, or other similar organizations. Nonprofit organizations that wish to be recognized as tax-exempt by the IRS and eligible to receive tax-deductible donations from individuals and organizations need to file Form 1023. This includes organizations such as charities, foundations, educational institutions, religious organizations, and certain types of social welfare organizations, among others. Filing Form 1023 is important as it provides a way for organizations to receive the benefits of tax-exempt status, which include reduced tax liability and the ability to attract tax-deductible donations to support their activities and mission. However, the application process can be complex and requires careful attention to detail and compliance with IRS regulations.

What Is tax exempt form?

Almost all enterprises and organizations have to report their financial information to the with the purpose of withholding the correct amount of a federal tax from their income. However, there can be some exceptions. The charity organizations such as corporations, unincorporated associations or trusts can claim the tax exemption. For this purpose they have to prepare a Form 1023, Application for Recognition of Exemption Under Section 501(c)(3) of the Internal Revenue Code. We have prepared for you a short guide to fill out an editable sample in PDF correctly and get a desirable result.

Before you start preparing a 1023 sample, you have to define if your organization is eligible to claim the exemption status. Fill it out if your organization's activity is related to:

- religion;

- education;

- charity;

- science;

- literature;

- testing public safety;

- fostering national or international amateur sports competition;

- preventing cruelty to children or animals.

The fillable blank should include detailed information about organization's activities and functioning. Also, some provisions have to contain data about:

- the applicant’s identification;

- organizational structure;

- information on employee relationship and financial arrangements with them.

After you finish, you can save a completed template in PDF to your device or print it out in a few clicks. A final 1023 template can be submitted electronically to the straight from the source.

Online options assist you to organize your document administration and enhance the efficiency of your respective workflow. Stick to the quick manual as a way to comprehensive Form 1023, keep clear of problems and furnish it in a very well timed fashion:

How to complete a Irs Form 1023?

- On the web site aided by the type, click Start off Now and pass for the editor.

- Use the clues to fill out the pertinent fields.

- Include your own facts and make contact with information.

- Make sure which you enter suitable data and quantities in ideal fields.

- Carefully check the articles of the type at the same time as grammar and spelling.

- Refer to help section in case you have any questions or address our Aid team.

- Put an electronic signature on the Form 1023 aided by the aid of Indicator Resource.

- Once the shape is done, push Executed.

- Distribute the all set form via electronic mail or fax, print it out or preserve on the unit.

PDF editor helps you to make improvements in your Form 1023 from any internet linked equipment, customize it in line with your requirements, sign it electronically and distribute in several ways.