Award-winning PDF software

West Palm Beach Florida Form 1023: What You Should Know

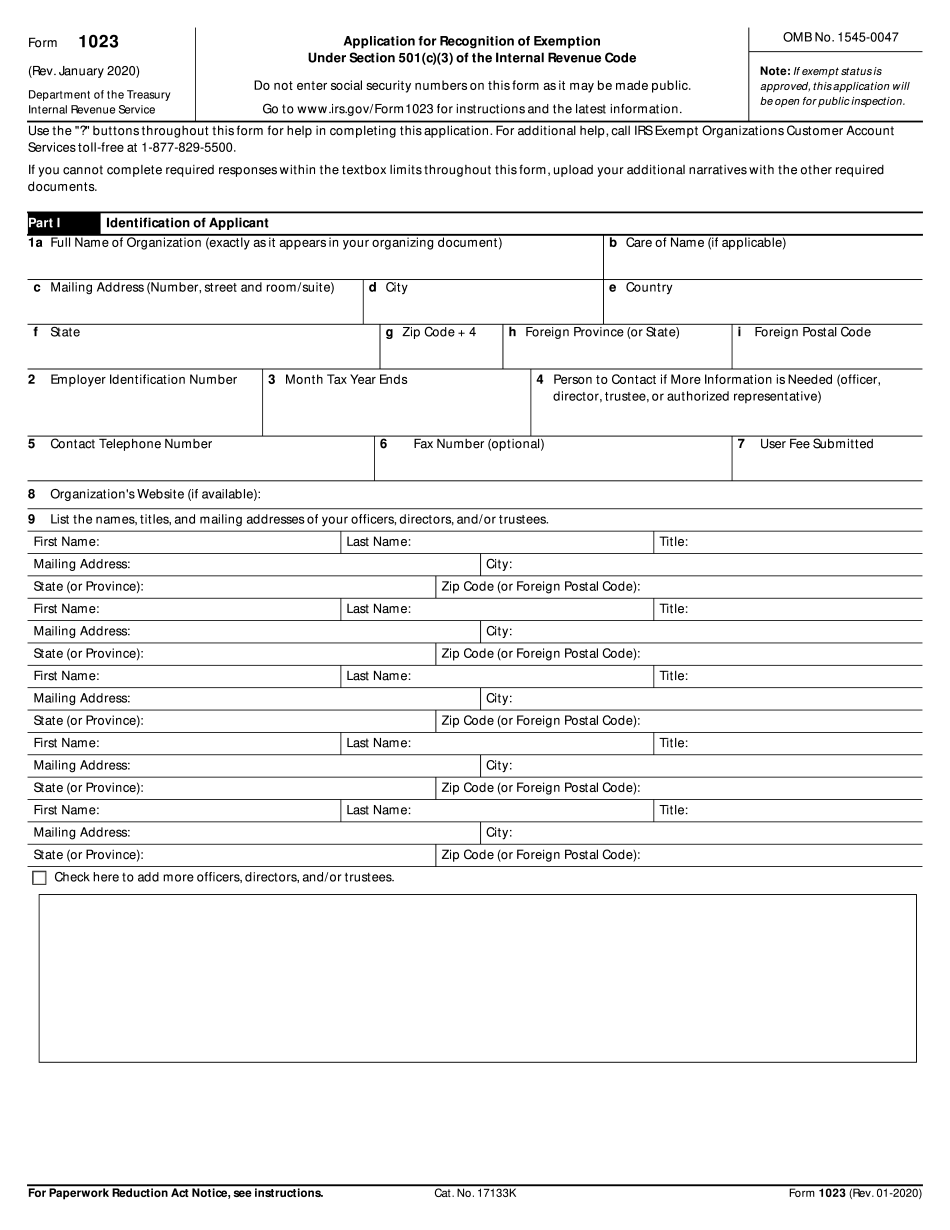

Form 1023-EZ (Rev. December 2017) — IRS Use the instructions to complete this application and for a definition of all bold items. The IRS Form 1023 application contains instructions and definitions for all items. For additional help, call IRS Exempt Organizations. Form 1023-EZ | Determination Letter | Templeton & Co — South FL CPA This is the first in a series of determination letters that will explain how the IRS will recognize the private foundation's use of a designated community asset (e.g., a tax-exempt facility). The letter explains how a private foundation may designate an additional community asset as a public community asset or a separate community asset. Form 1023-EZ | Determination Letter | South FL CPA Firm We recommend this is the first letter in the series; however, this process can be complicated without help and advice from Templeton & Co-South Florida CPA. G:\Former Employees\Kalyan\form 1023.tif 1. Application for Recognition of Exemption. Form 1023 (Rev. December 2017) — IRS Use the instructions to complete this application and for a definition of all bold items. If you use different language for different types of assets, make sure all the forms are identical. If the document is not available in all forms, do this. Form 1023-EZ | Determination Letter | Templeton & Co — South FL CPA Learn about the new IRS Form 1023-EZ filing requirements for private foundations and the importance of determination letters— Templeton & Co — South FL CPA If you're a person or business owner that owns tax-exempt property located in or affected by a community asset. You may qualify for community asset status as provided in section 501(c) of the Internal Revenue Code and Section 482(a) of the Internal Revenue Code. This includes a community asset that is an asset of, or within the limits of, a charitable organization or association. See examples below. EIN: If you own or have ownership interest in, or maintain control over, an asset. The EIN number should not be used when determining whether the private foundation is a tax-exempt organization.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete West Palm Beach Florida Form 1023, keep away from glitches and furnish it inside a timely method:

How to complete a West Palm Beach Florida Form 1023?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your West Palm Beach Florida Form 1023 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your West Palm Beach Florida Form 1023 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.